The best savings of savings today, March 11, 2025 (tax rate at 4.30% APY)

The federal reserve has reduced their targeting interest rate three times in the 2024. As a result, the high-red savings account rates have been fell. It says, some of the best counts always pay over 4% apia.

To obtain the highest interest rate as possible on your savings, it is important to make your search and find competitive deals. Not sure where you start? That’s a look closer to savings interest rates today and where you can find the best.

The rate of the average interest on a Traditional savings account It’s only 0.41%, according to the fic. However, the best savings rats can be found in high teeth accounts, who often paid many more.

On 11 March 2025, 2025, the highest savings account available from our companions is 4.30% API. This fee is offered by CIT Bank and there is a minimum opening depot of $ 5,000 needed.

Read our Full A Bank review review

Here are a look at some of the best savings rates available today by our verified partners:

This embedded content is not available in your region.

In relation: 10 BEST-Income Account Accounts Available Today >>

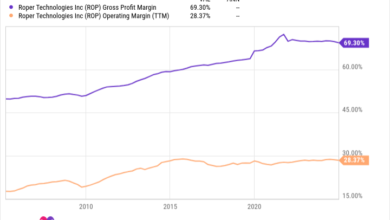

The last decade, savings interest fees are fluctuated enough. By 2010 to about 2015, fees were at the bottom of rock, through approximately 0.06% to 0.10%. This was largely because of the 2008 financial crisis and the Federal ReserveThe decision decision of the target rate near zero in order to express economic growth.

By 2015 to 2018, roofs of interest start to grow gradually. However, have been low by historic standards. Then the beginning of the cottage cottage in 2020 led to another sudden sharpness of rates when the Fed once you cut again to stimulate the economy. This brought savings of medium savings to the new lows, around 0.05% to 0.06% from the middle of the 2021.

Since saving account rates recoverably considerably, largely driven by the fed Hikes of interest rate in response to the swelling of skyrocketing. However, the Mandheria finally dropped Federi funds in September, November and December 2024, and as a result, the deposit reverses that start down

The following are a look at the interest rates that saves are changed in the past decides:

Despite the fact that interest rates were raised 2021, average account rate is always low enough, especially compared to market investments. If you have saved for a long time purpose as the child or retirement education, a savings account, do not usually have the necessary returns to reach your goal.

On the other hand, if you save you for an emergency background, home, or other purpose to no time is ideal – especially if you want to access funds. Other types of deposit accounts, including Markets and cd of moneycan offer similar rates or even better, but restricts how often you can get retired. The key is to buy around and find an account that provides a competitive fee with low or no fees.

https://s.yimg.com/ny/api/res/1.2/A7DEb1HTJhU8VDh5EPsFWQ–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://s.yimg.com/os/creatr-uploaded-images/2024-07/61b31c70-4eb5-11ef-bef7-1c95e6978ba4

2025-03-11 13:00:00