Amazon spends almost a year of ARS income to AI investments

There is a little AI spending a steady upside between hyperscalers and builders in the clouds with their new sugar roads to take a lot of AI estates to push the state of art in model capabilities and intelligence.

It’s like Amazon, through Amazon Web Services Cloud, winning AI Budget Bonanza Game. In a conference call with Wall Street analysts to go to the fourth quarter of 2024 financial results for Chief Financial Officer Brian Olsavsky said:

“Capital investments are $ 26.3 billion in the fourth quarter, and we think that rate rate can reasonably represent our 2025 capital investment capital. Similar to 2024, most of the spending is to support increased demand for technology infrastructure. It is mainly associated with AWS, including supporting demand for our AI services as well as Tech infrastructure and international which parts. “

After the call, Olsavsky repeated that the capital expenditure rate for Amazon at Q4 2025, means that Amazon will spend the north of $ 100 billion assets – and we need to know because Amazon does not disclose it – so over 90 percent of capital systems can be for AI systems and the data that wraps around them. If you do that math, it works at $ 86 billion in AI Datacenter to spend 2025, more or less.

As far as we can identify from our own model, information technology is an increased part of the Amazon capital budget in 2006 dollars as the cloud increases to aws. Since the first quarter of 2008, Amazon invested $ 469.7 billion assets and equipment, which is a shocking amount of money until it is Amazon’s ballpark, Google Clatforms to spend the capital costs on the calendar. (That’s $ 80 billion for Microsoft, $ 75 billion for Google, $ 65 billion for Meta platforms, and $ 100 billion for Amazon.)

We think Amazon is around $ 38.4 billion in this infrastructure printing of 2023, and $ 30.1 billion servers AI and the data picking them. Another $ 8.2 billion for generic datacenter and servers, storage, and switches inside it. In 2024, we think this generic datacenter spending at Amazon (which means aws) was up 13.2 percent to $ 9.3 billion, and ai datacenter spending at Amazon (again allocated to aws) Doubled to just under $ 60 billion. Amazon spent another $ 14.6 billion for fulfillment centers, transportation systems, and office space, which reduced 4.7 percent.

This model has a set of magic on it, we believe, and we make some thoughts about how to share it. If we run the Security and Exchange Commission, such revelations will be done as something you need to have more financials.

The odd thing about the size of 2025 capital capital capital for the same order in the size of the COMPANY CLOUD proceeds at $ 90.76 billion. In 2024, the annual income of AWS has grown 18.5 percent of $ 107.6 billion. Method in February 2019, We say aws are definitely broken $ 100 billion in annual sales of 2026to be 20IK Anniversary to launch the bookseller cloud

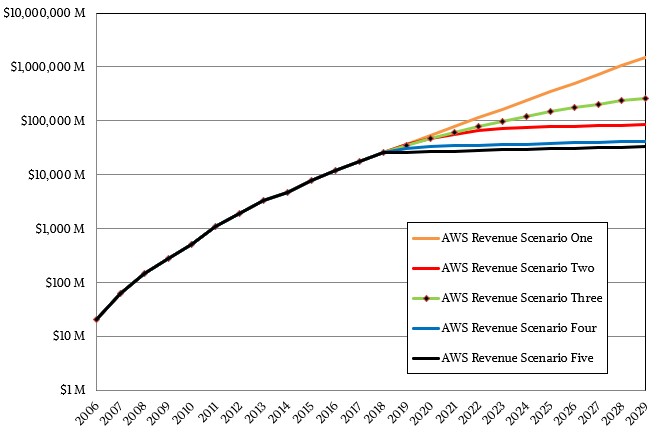

By the way, only for entertainment, here is the chart we make for income projections, and we say that three through, which progresses slowly:

To that model above, scenario three, which we chose as the most likely trail in aws, there is 2123 billion in 2024. So Jeff and Andy, good work, good job, You almost met our expectations. . . .

The thing we have to tear our heads is that investment in AI Gear every quarter and every year is greater – and greater than income in times of times. The ratio of this investment to operate the average average 1.72x in 2024 and averaged 1.58x in 2023; Sometimes, the ratio is twice as large. In Q4 2024, for example, the ratio of this expenditure for AWS income operating is 2.3x, for example.

How is it lasting? Well, you have to spend money to make money.

For servers and the data wrapping them, As we shown hereFor every $ 1 you spend a cluster in AI and including this power and cools), you get 87.8 cents out of customers and reserved hours and a $ 9.40 each rate to GPU-time. In 410 days, you get your Bain throughout AI investment when you break all GPUs. The model we made (riffing a nVidia model) shows that in three years after that, 87.8 cents each year go to your pocket. After that, you have to pay some extra power and cool the cost out for five years. Call this 75 cent profit every year. Press GPU in the field for a decade – and no reason to believe that it does not happen in NVIVIA “Hopper” H100 Pachus

It is difficult to find a better business. Which reason we see Tech Titans all plowing a lot of money in AI hardware and datacacentters wrapping around them. They also want to sell money on AI models, which are different (but relevant) stories.

So let’s take the inputs from Big Four and see what outputs. The $ 80 billion plus plus at Microsoft Plus Plus Plus Plus plus $ 75 billion $ 86 billion in Amazon (from our financial model) $ 306 billion. Output, in terms of income, in the next decade from renting a great Ai AI capability, which claim without a price collapse, is $ 1,912.5 billion. Price-cutting acquisitions over time moderate, call it $ 1.5 trillion in output. If you could add your money in 5x in a decade of AI Gravy Train, aren’t you?

This is why Amazon is, and therefore aws, there is an aggressive nature of it.

“Most capex spent is on AI for AI for ARS,” Picoke Executive Elegortice Officer Andy Jassy Jassy Jassy says. “This is the way business moves to aws. The way the cash cycle works that the fastest we grow, the more capex we end up spending because we need to get datacenter and hardware and hardware and hardware tools and chips and networking ahead. But we do not get it unless we see important signals of need. And so, if aws are growing in this capex, especially for what we think is one of these business opportunities like a great term medium-to-long term for aws business. And I thought it was spending this chance to keep this opportunity, which we have come from our eyes, There is ai inside and with a core building block that just saves database. “

See you? All this spending is a leading indication of boom times to come.

In a bit of the call, Jassy has more to say about this exciting AI investment and the fact that aws can be more aggressive if it is not for supply supply issues:

“It’s hard to complain if there is a multi-billion annual Road Rate Rate in AI as we do and grows in a triple percentage year-over. However. It is difficult to complain We can grow faster if not for some capacity constraints. And they come to the form high-quality servers that we expect. We come to our own new reception Hardware and our own Trierium2 ships, we are going to mostly available on ReVe: but most of the number comes to the next couple. “

So many of the capital expenditure of 2025 is to catch the NVIDIA system “Blackwell” and pay The Trainium2 Rampawhich is happening To support AI Model Moter Makrropic As well as other customers using AWS Sagemaker and modeling services in bed ai.

To say to all of that, we will drill the consequences for the fourth quarter.

In Q4, the revenues of the AWS of 28.79 billion, up to 18.9 percent year of year and by 4.9 percent in a row. Operating revenue is $ 10.63 billion, up to 48.3 percent compared to the previous period and represent Revenue Stream, which is a supplier of income and a software supplier, which is the AWS Cloud.

We think thanks for growing Cloud computing in total and AI training AI, ARS development charges and networking at high levels of software flattening. It can look like this:

We have consulted this chart just a conflict, not based on anything other than our chirps. In the absence of real data, the subjects must be done. Like this:

Kirk: Mr. Spock, are you considering the variable mass of whales and water during your entry entry time?

Spock: Mr. Scott can’t give me exact numbers, admiral, so … I’ll think.

Kirk: A prophecy? You, Pake? That’s extraordinary.

Spock: (To Dr. McCoy) I don’t think he understands.

McCoy: No, space. She meant she feels better than your predictions than most of the facts of other people.

Spock: Then you say. . .

(pause)

Spock: It’s a compliment?

McCoy: It is.

Spock: Ah. Then I will try to make the best guess I can.

McCoy: Please do.

In any event, while companies capture AI models delivered to ARS and use them in AI models and see them on actual levels of aws / performance curves. You also see the revenue curve of Revenue Flex as well as the budget moves more than software and distance to hardware.

These are temporary conditions for compute. Remember that. In the long run, the software often represents most of this value.

One last thing: there is an interesting interpretation of decline for datacentters and warehouses that occur in Amazon.

Olesavsky says AWS increases the “useful life,” a technical assertion, enlarged aws margins of Q4 2024. It is interesting that these beneficial systems are and reduce useful Life on older servers and network gears from six years to 2025, to decrease at $ 700 million. OLSAVSKY Said That Amazon Also Records A Q4 2024 Charge of $ 920 Million From Accelerated Depreciation For Other Server and Networking Equipment, and Networking Equipment Will Be Taken by Amazon in 2025. Amazon Looked Around Its Fulfillment warehouses and viewed useful lives of heavy equipment used here and decided to keep the useful life in this gear from ten years of $ 900 million Pay for server and networking writsoffs come this year.

http://www.nextplatform.com/wp-content/uploads/2024/12/aws-reinvent-2024-trainium2-racks-logo.jpg

2025-02-07 22:15:00