Analysts that preach most earn for gold in 2025

Via Miner of metal

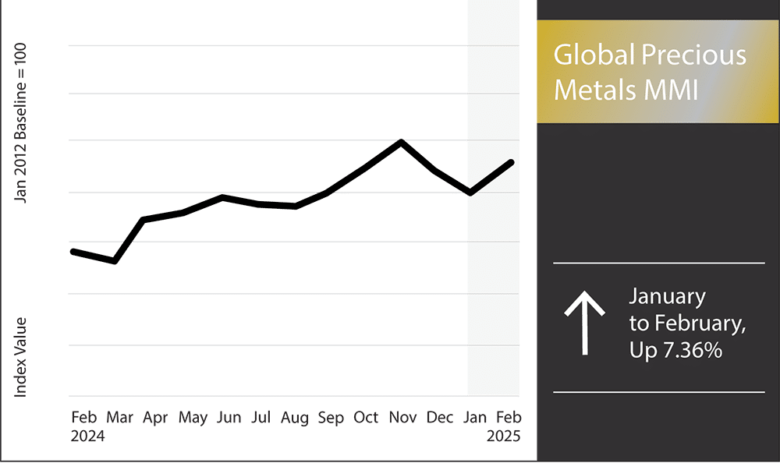

The precious mmi global metal (Monthly metal indices) experienced a significance of the month-over-month of the month, pulled 7.36%. The past month attempted a precious metal pan, with each metal reacts to economic conditions and recent policy changes.

Palladade has experienced a particularly volatile month. The pricing initially went in January because of the seasonal request and a wide rally through the precious metal market. However, according to Macotstrends.net, the beginning of February has deleted some of those earn. I am The February, Sibanye Severiever always has always practice to the backup renders, which could add some long-term bullish pressure.

Meanwhile, Trump administration introduced new, injecting additional uncertainty in the markets of the paladium. While none of the international rates including the palladum in a general manner, the maller merchand the metal markets seemed to reverberate on the palladium market. Despite this, analysts are waiting for palladum prices to lower in the Come by coming. I am

Subscribe to the metal metal’s wemlet of metal metal metal The weekly market and macroeconomic news.

Platinum prices have held relatively stable despite the recent policies changes. Generally have experienced only the minor months of the month. Despite a strong US dollar and push the industrial request, most of the market experts remain optimistic about the future of the Platinum. Meanwhile, analysts Project a supply deficit between 2025 as a question from the automotive and industrial the sectors continue to grow. I am

Silver prices are stopped in the way to the new year, you arrive $ 32.80 to ounces half of February-the highest level from half December 2024.

Source: Useless of the metalliner

Due to economic ecroise uncertainty and geopolitical risks, investors turned to the silver as an asset of a safe HAVEN. As a result, analysts remain bullish on the widening of silver across 2025.

The gold has taken a center stage of the precious metals metals month-over-mont. According to ReudersAsset hit all the $ 2,942.70 to say to an economic politics, geopolitical purchases and shopkeeper and aggressive and aggressively despathers to recover again cum ‘ and half of February.

Source: Useless of the metalliner

The major finance institutions raised their predictions in response to the time of gold. For example, Ubs analyst Joni turned a little time that gold could push $ 3.200 per waves later this year before stabilizing. In your me? Goldman Sachs has increased their year’s projection to $ 3,100 to ounce.

https://media.zenfs.com/en/oilprice.com/3a871d3e30791e0f628760a933486019

2025-02-23 21:00:00