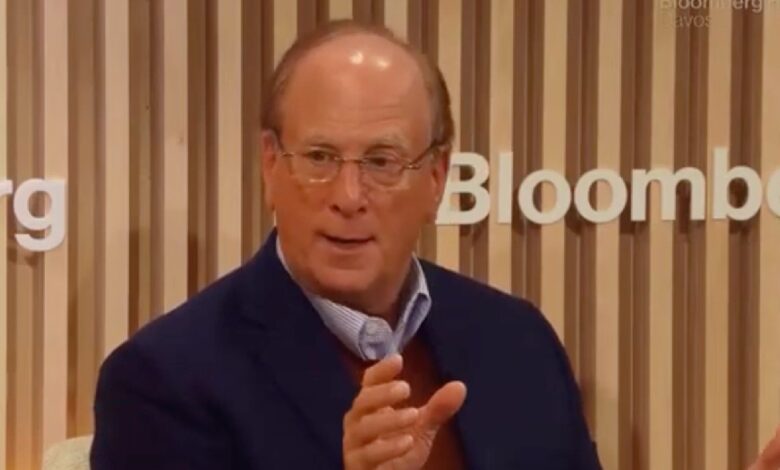

Blackrock CEO Calls Crypto a ‘Fear Currency’ (Complimentary)

Blackrock CEO Larry Fink thinks bitcoin, which is currently priced at around $104,200, could go as high as $700,000. But this is only if people get really nervous about the stability of their currencies around the world. And while it is anyone’s guess whether Fink’s logic is sound and people would really flock to crypto in times of crisis (this extremely common thesis has yet to be proven), it is certainly true that the election of Donald Trump has the potential to inject a lot. instability in the global economic landscape.

Fink made the prediction about the future price of bitcoin on Wednesday at the World Economic Forum in Davos, Switzerland, while discussing the outlook for technologies such as artificial intelligence and cryptography with Bloomberg. Fink had been a crypto skeptic in the late 2010s, saying back in 2017 that, “Bitcoin just shows you how much money laundering demand there is in the world.” But the billionaire has changed his mind in recent years, becoming a true believer in the promise of crypto by 2021.

Fink seems to not only believe that crypto is now a positive thing, but that this reliance on fear is actually an asset. The billionaire thinks that people can make a lot of money from instability or at least worries about instability in the world.

“When I became a student of crypto, it was very clear to me that crypto is a currency of fear. And that’s okay,” Fink during the panel on Wednesday that is available YouTube.

Fink shared the stage with Peng Xiao, the CEO of AI company G42, who intervened “to some extent” on Fink’s argument that fear drives bitcoin. But Fink only doubled down on the idea that it was “good” for bitcoin’s fortunes to rely on fear.

“If you are afraid of your currency degradation or you are afraid of your economic or political stability of your country, you can have an internationally based instrument called bitcoin that will overcome those local fears. And so I am a great believer in using it as a tool,” Fink said.

Fink said the price of bitcoin could reach “$500,000, $600,000, $700,000 per Bitcoin” while emphasizing “I’m not promoting this, by the way.”

Fink also said he believed bonds and shares should be “tokenized.” For what? This part isn’t clear, since it doesn’t make a damn sense. But why not? We went through this same bullshit hype cycle a few years ago when everyone jumped on the NFT bandwagon and tokenizing things that don’t need to be tokenized may very well have another resurgence.

“The fact that we haven’t moved forward in tokenization, every link and stock is crazy,” said Fink. “We have to go towards that border. Obviously, there are winners and losers and all that. But we have to be prepared for tokenization. And it would democratize more finance if we tokenized bonds and stocks.”

Fink also discussed the power needs of the huge data centers that continue to be built around the world to serve the needs of AI. Those data centers require large amounts of power, which Fink addressed by talking about nuclear power as a potential fix.

“We need a lot of energy partners to be able to make this a viable global commitment,” Fink said. “And I hope this sparks a conversation about what role nuclear plays in the energy mix.”

Fink gave a nod to renewables, saying they will be part of the mix, but said that “unless fusion really works and we have new sources of power,” we need to work with what’s available.

There are some big questions about the future of the US economy that are currently being discussed in Davos and beyond. Inflation, for example, does not seem to be something that the ruling class is too afraid of anymore, despite the presidential elections of the United States of 2024 essentially depend on whether a new president could lower prices.

JPMorgan CEO Jamie Dimon was asked about Trump’s plans for tariffs across Mexico and Canada, which are expected to be implemented around February 1.

“If it’s a little inflationary, but it’s good for national security, so be it. I mean, get over it,” Dimon told CNBC’s Andrew Ross Sorkin Wednesday.

That sounds like a good mantra for the rich in this new Trump era: So be it, get over it. We’ll probably hear a lot of it if Trump succeeds in torpedoing the economy. That’s probably not what most Trump supporters thought they were signing up for when they voted for the 47th president. But that’s certainly what they’re going to get.

https://gizmodo.com/app/uploads/2025/01/larry-fink-bloomberg.jpg

2025-01-22 23:35:00