Hedge fund managers pocket nearly half of investment earnings as fees

Stay informed with free updates

Simply sign up to the Hedge funds myFT Digest – delivered straight to your inbox.

Investors in hedge funds have paid nearly half of their profits in fees since the industry’s early days more than half a century ago, new data shows.

Managers generated $3.7 billion in total earnings before fees, but fees charged to investors were $1.8 billion, or about 49 percent of gross earnings, according to analysis by LCH Investments, a hedge fund investor.

The figures, which date back to 1969, show how the scale of fees charged by managers has grown as the industry has matured.

“Until the year 2000, the rate of the hedge funds had been reached at about a third of the total earnings, but since then it has increased to half,” he said.

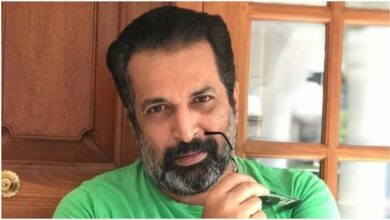

Rick Sopher, CEO of Edmond de Rothschild Capital Holdings and Chairman of LCH Investments. “As returns have gone down, fees have gone up.”

The new research comes after the world’s 20 most successful hedge funds made their biggest profits on record in 2024, according to LCH – for the second year in a row and against a backdrop of rising stock markets.

The best performers last year, which provided the best returns net of fees, were three multi-strategy hedge funds: DE Shaw, Izzy Englander’s Millennium Management and Ken Griffin’s Citadel. They also have some of the highest overall charges.

Citadel cemented its position as the most profitable hedge fund of all time in 2024, topping the rankings for the third consecutive year, with DE Shaw and Millennium in second and third place, respectively.

The top 20 managers in the $4.5 billion hedge fund industry made total profits for investors of $93.9 billion in 2024, LCH said, up from the previous record of $67 billion in 2023 .

Together, the top 20 generated an asset-weighted return of 13.1 percent, significantly outperforming the average hedge fund, which made 8.3 percent, according to other data from Hedge Fund Research.

Managers in the top 20 had a much lower overall rate for just over a third of gross earnings, compared with 55.7 percent for the rest of the industry since the start, LCH found.

Hedge funds have historically been known for a “two and 20” fee model, where investors pay 2 percent in management fees each year and a 20 percent return on investment earnings.

However, this has been under pressure since the global financial crisis, as investors have complained about the performance and the lack of protection against market falls.

The increase in general fee take from 30 percent to about 50 percent of gross earnings is largely due to higher management fees, according to LCH.

While management fees ate up less than 10 percent of gross earnings in the late 1960s and 1970s, they have accounted for nearly 30 percent in the past two decades, LCH said.

The change suggests that efforts by institutional investors and investment consultants to cut fees across the board have failed, with management fees gobbling up more of the returns while earnings have declined.

The fastest growing corner of the hedge fund industry has been multi-manager platforms, which have increased average fees, according to top brokers.

Such firms have a “pass-through” expense model, where the manager passes all costs on to their end investors instead of taking an annual management fee.

That can cover office rent, technology and data, salaries, bonuses and even client entertainment. It typically ranges from 3 to 10 percent of assets per year. A performance fee of 20-30 percent of profits is usually paid on top.

The LCH list calculates which managers are most successful based on the cumulative dollar profits they have made for investors, net of fees, since inception. The sources for the calculations were LCH’s internal estimates, as well as data from Nasdaq eVestment and HFR.

Sopher said that LCH as a fund would close this year, but that Edmond de Rothschild would continue to invest in hedge funds through other funds in the group.

LCH, one of the first funds in the world of hedge funds, was founded in 1969. The value of a share, if purchased at the launch of the fund, multiplied by 172 times to December 31 2024, representing a return of 9.8 percent annually.

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F13d3818c-cb8f-4516-9477-73abffad25e8.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-01-20 03:01:00