Here’s how an expected Fed rate cut could affect crypto

Bitcoin’s Sunday Night Rise Above $105,000 While analysts see the change in monetary policy as more of a confirmation than a catalyst for alpha crypto’s next moves, it comes against a backdrop of broader market expectations for the Federal Reserve’s expected interest rate cut.

The leading crypto rallied 3.5% over the past 24 hours to $105,004 as several tailwinds, including the US election results and spot ETF flows, gave it bullish momentum.

The Federal Reserve is expected to cut rates by 25 basis points to 4.25% to 4.50%, the Federal Open Market Committee said at its meeting this week. CME’s FedWatch tool.

At press time, the tool is showing a 93.4% chance, marking the second consecutive cut after the November cut.

“I don’t believe the Fed rate cut will have a significant impact on the price trend, as the market has been waiting for it for at least a few weeks,” said Luis Buenaventura, head of crypto at GCash. Deciphering.

Buenaventura notes that historical data shows two-thirds of the time Bitcoin has risen 50% within 60 days, followed by an additional 35% gain in the two months following the decline.

“Bitcoin is up 50% in the last few weeks, so the odds are in our favor that the momentum will continue,” noted Buenaventura.

Market watchers also cite structural factors in addition to exchange rate policies that are boosting crypto prices. Former PayPal COO David Sachs has been appointed.White House AI and Crypto King” and proposals on the Crypto Advisory Board represent growing institutional involvement.

These macroeconomic factors have historically fueled Bitcoin’s growth as investors seek alternatives to traditional assets in a low-rate environment, said Neil Wen, head of Global BD at Kronos Research. Deciphering.

Bitcoin is king

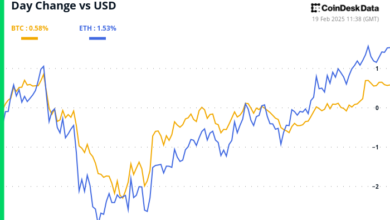

Bitcoin’s rally above $105,000 followed a 145% year-to-date gain, tracking its 50% price increase since the US presidential election.

The broader crypto market followed this momentum with Ether (ETH). It will return to the $4,000 levelIt is down about 17% from its previous high in November 2021.

“While the rate cut is favorable for Bitcoin’s price, the market appears to have fallen 25 basis points in December,” said Min Jung, a research analyst at Presto Labs. Deciphering. “As a result, a drop in the actual rate may have minimal direct impact on the price of Bitcoin.”

As the Fed prepares for its announcement in two days, traders will focus on technical indicators and adoption figures rather than rate policy, suggesting that Bitcoin’s trajectory may depend more on market structure and institutional participation than traditional monetary factors.

“Instead, the focus will be on the December FOMC meeting’s Economic Projection Summary (dot plot) and Powell’s comments on future rate cuts,” Jung said. “These factors, especially any unexpected events or unexpected events, could be key drivers of Bitcoin’s price.”

Edited by Sebastian Sinclair

Daily information Bulletin

Start each day now with the best news, plus original features, podcasts, videos and more.

Source link

https://cdn.decrypt.co/resize/1024/height/512/wp-content/uploads/2021/11/federal-reserve-sunset-gID_7.png