How to Buy Bitcoin During a Bull Market Decline

Buying Bitcoin at a much higher price than a few months ago can be dangerous. However, with the right strategies, you can buy Bitcoin during the dip with a favorable risk-reward ratio while riding the bull market.

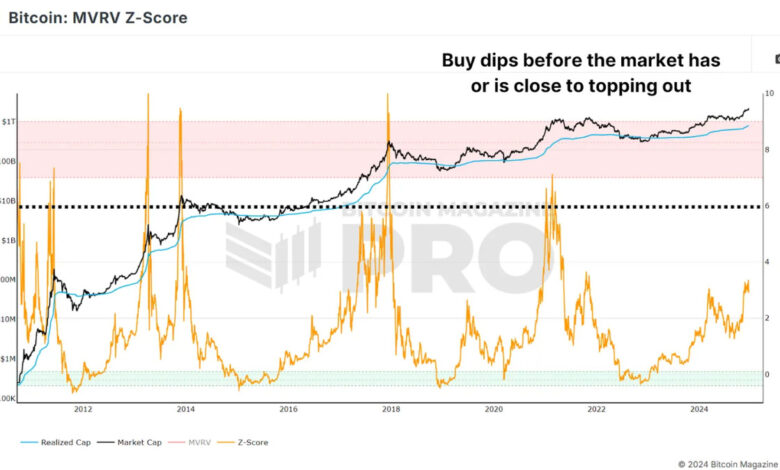

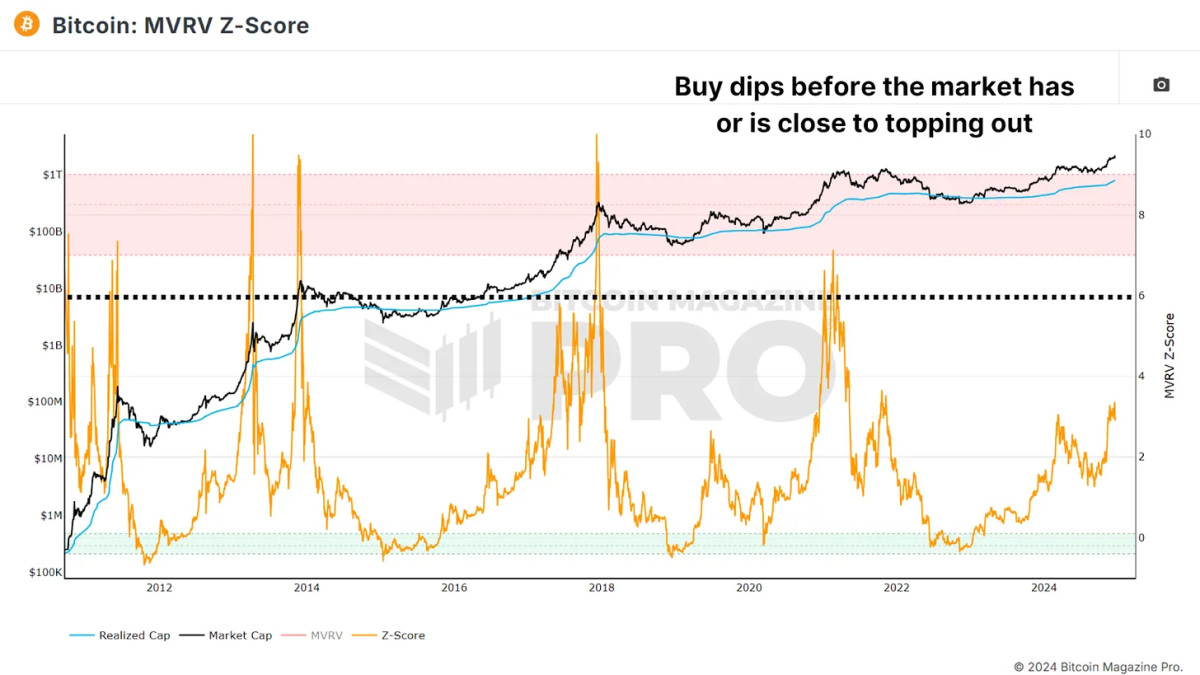

Confirmation of Bull Market conditions

Before you stock up, make sure you’re still in a bull market. MVRV Z-score helps identify overheated or undervalued conditions by analyzing the deviation between market value and realized value.

Avoid Buy when the Z-score reaches high values such as above 6.00, which indicates that the market is overextended and approaching a potential bearish reversal. If the Z-score is lower than this, the bottoms probably represent opportunities, especially if the other indicators match. Do not accumulate aggressively in a bear market. Instead, focus on finding the macro bottom.

Short term owners

This chart provides a glimpse into the performance of the Short-term holder, reflecting the average value of new market entrants. Historically, in bull cycles, when prices rebound Short-term holder real value The line (or a little lower), gave great opportunities to accumulate.

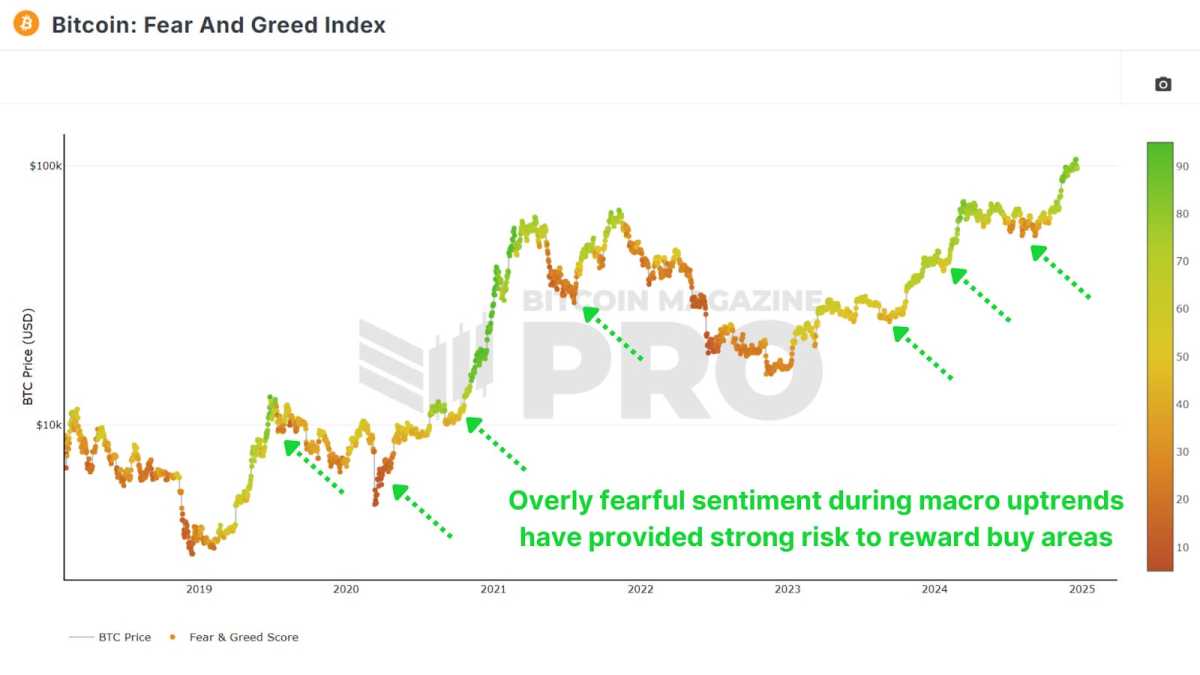

Measuring market sentiment

Although simple, Fear and Greed Index provides valuable insight into market sentiment. Scores of 25 or below represent extreme risk, often accompanied by irrational sales. These minutes offer attractive risk-reward conditions.

Identifying market overreaction

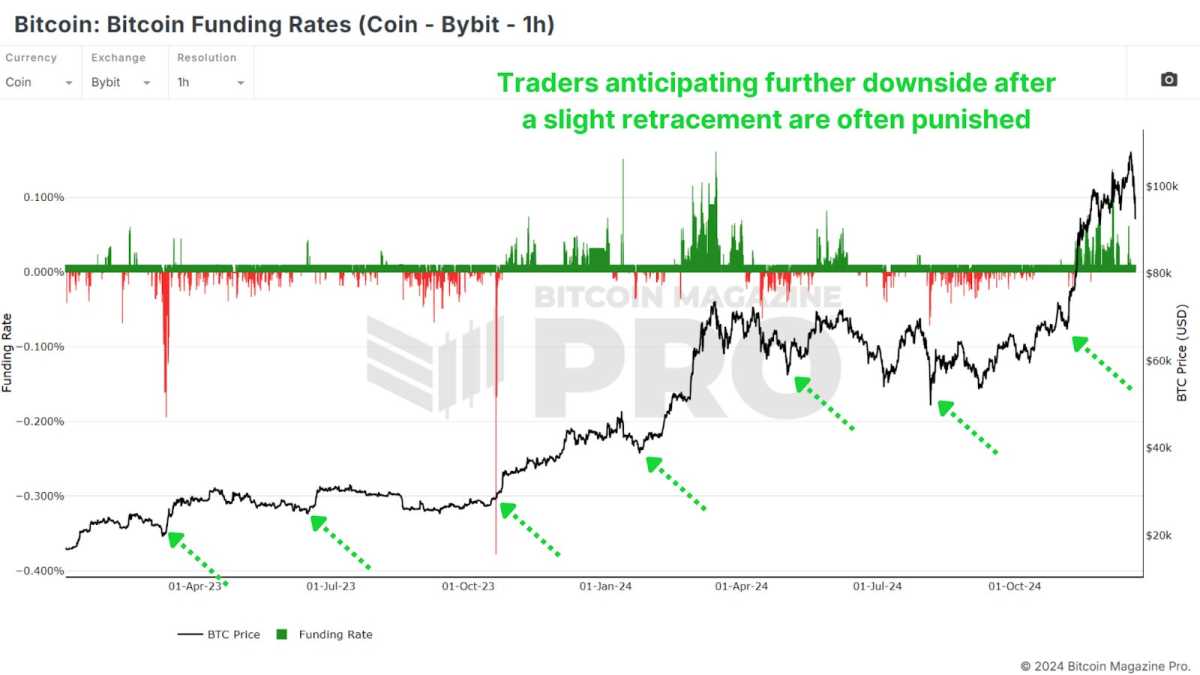

Financing rates reflects trader sentiment in futures markets. Negative financing in bull cycles is particularly telling. Exchanges like Bybit, which attract retail investors, show that negative rates are a strong signal to accumulate during a downturn.

When traders use BTC as collateral, negative indicators often represent excellent buying opportunities, as those shorting Bitcoin are cautious and deliberate. That’s why I prefer to focus on coin funding rates rather than regular dollar rates.

Active Address Sense Indicator

This tool measures the difference between Bitcoin price and network activity, when we notice differences. Active Address Sense Indicator (AASI) This suggests that the price has a very bearish tendency given how strong the underlying network usage is.

My preferred method of use is to wait until the 28-day percentage change falls below the lower standard deviation band of the 28-day percentage change in active addresses and cross back above. This buy signal confirms the strength of the market and often signals reversals.

Conclusion

Accumulating during a bull market decline involves managing risk rather than bottoming out. Buying in slightly higher but oversold conditions reduces the probability of a decline by 20%-40% compared to buying during a sharp rally.

Confirm that we are still in a bull market and the decline is for buying, then identify buy areas by combining several indicators such as the real price of the short-term holder, fear and greed index, funding rates and AASI. Prioritize small, incremental purchases (dollar cost averaging) and focus on risk-reward rather than absolute dollar amounts.

By combining these strategies, you can make informed decisions and take advantage of the unique opportunities that bull market downturns offer. For a more in-depth look at this topic, check out the latest YouTube video here: How to Accumulate Bitcoin Bull Market Dips

For more Bitcoin analysis and access to advanced features like live charts, personalized indicator alerts and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your research before making any investment decision.

Source link

[og_img]