M & A & A and Fabrician Games Offer 34% in 2024 | Stella Drake

Gaming and purchases (M & A) and financial funders in 2024 Grows $ 27.3 billion in addition of declined in addition to 967 transactions Star Drake partners. I am

Here’s a glimmer of bright news in a while when the entries has approved the fangs stagnate and game placed more than 15,000 people. I am In fact, the Gdc probe noticed that in 2024, one in every 11 developers that have been prepared.

Public Indicial to recovery with the sorting star gaming Gaming Gaming, 10% for the Michael Mappeters’ fitted, AN M & A Consulting.

The reasons this is the whole financially is the great compounds of purchasing, for private acquisitions and paintings are growing during the year, that was not the more weaker times.

“It was also a good year, a robust year with more than $ 27 the malionery of the trading value, which is the 3rd day, more that is definitely a positive,, he said Misszger. “Funding has two components. One is private is public. The companies can raise the debt. The number of 39% refers to the most money the eraser, a furcine of money in the ecosystem and then be used to grow inorganically. The remaining companies therefore become larger. ”

M & an offers

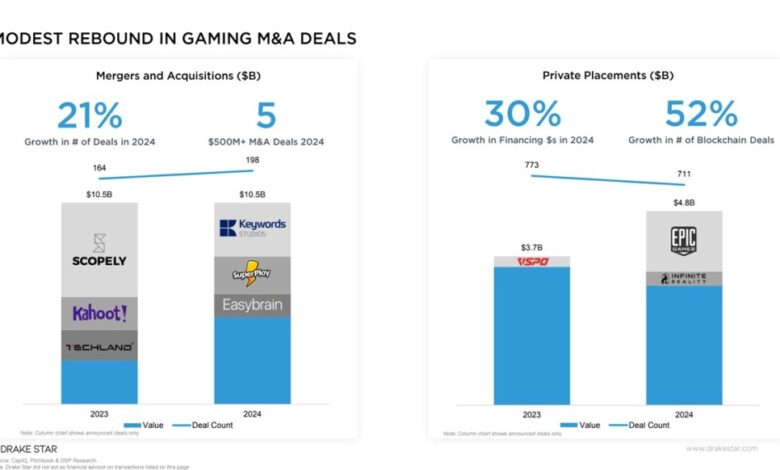

M & an activity in 2024 increased a 9% of the cover more than 2023, with 198 announced and $ 10.5b value. As planned, many m & a offers emerged by private equity companies, including the acquisition of Eqt of Eqt of the key words of keywords and The purchase of $ 1.1 billion Jagex cvc. I am

Metzger focused on the fact that M & the offers number went on the M & ATTENGO’s front for the general value for the same. Private funding trade values were lifting a little, but much was the most away from the Disney $ 1.5 billion investment in epic games. Without the treatment, private funding would be more on the flat side.

Other major transactions including Superplay PlayTY Purchase for up to $ 1.95 billion (Including the $ 1,2 course of $ 1,2 billionafter to the Miniclip of Tickle.

The report said the PC and console segment has been the most active in M & A with 53 Offers, follow from mobile with 38 business and platform with 32.

Private placements

While M & the reflects on a macro level between grain companies, the private investments show the health of smaller bulk. This picture was a little mixed.

A total of $ 4.8 billion has been raised through 711 reflecting 30% increase in the total disclaimed value but an 8% decline in the 2023.

MAJOR OF PRIVATE FINDLE INCLUDE 1 $ 1.5 million the LED of the significant roless of the reality of infinity initial scale consisting more than 90% of the total exit. Blockchain remains the most active segment with 250 deals, followed by the platform and tools (133) and mobile (111).

The fourth quarter was slower in terms of private financing offers. The Eve of Attraction gear is deprived are active in the market and are more inventions that come in the toys from places as the Middle East. Those with successful expectations will be likely to put more money in toys. Generally, who makes the optimistic metzer that money will continue to defend in the game industry.

Investors have insured more $ 1.8 billion more than they grow dnew. That includes funds of followed by A16Z (600 million), Bitter (275 $ million), Vgamese ($ 142 million), and Playing venture ($ 140 million), together with new funds launched by Great time ($ 150 million) and Window wind (150 million).

As regarded new funds, it was loudly in the last few years, and now is a debit, Methzer said. “Vgamese especially had the biggest exit with the Playtika’s trait”, he said.

The most noticeable of public officles included the very successful iPo of the Shift in South Korea and the South Power

On the public Market, Star Drake’s Gaming Index, which runs the 30 companies Gaming Gaming on a weighted basis of equal, roses 10.4% per year. It is willing to experience strong from the sea / garena, dena, and konami. Meanwhile, Corsair, wemaite, and units were the most debt stock in the index.

Q4 2024 results

In Q4 2024, there were 15 deprived patches, with a total of $ 650 million than the quarter ready (1824) and one year ago (170 in Q4 2023) . I am There was 47 offers in the Bockchain sector, making the largest sector with about $ 200 million released in the fourth.

Gaming M & A was even smaller in Q4, with 40 sunsets compared to 57 in the previous quarter and 44 in Q4 2023.

Outlook

Staring Star partners has a jets and technologist market in 2025 with strategic conseponsidities, private interest and a village regulation evolution.

As companies assessments of the listed gaming continues to repay, anticipate anticipate a significant Uptick in M & an activity. The Keywords to keep you will include safeguard / goals, tencec, Krafton, key realities used here and the new Indian uses, as the ASMODEE.

Private business are prevented to remain very active, with many businesses advertised by the Potty Pistecy Potent Gaming. Ubisoft could be between the greatest candidates for a deliser in 2025, as he assured strategic advisers, maybe to take the private company.

With more than 1.8 billion of $ 824 investor investor investigation of investigation, ancient figure of a strong pipeline of a strong pipeline and before selecting.

However, there are useless they make it difficult for some companies. There will be winners and loses, and AMIR SATVAT, the workmanship on work, noticed that people are likely to be resumed in 205 and also significant.

“For some of those companies focused, depends on the sector focused in your headlines. Ubisoft is likely to have the titles have not done. And there are future launch are pushed in the future. That probably has not helped “, the metzger said.

As the result, Ubisoft saw a 46% decay in its assessment during 2024. Here is a reason that is always placed people.

“It’s a bag mixed with those who are obviously very unfortunate for those people who are arranged, and uneaction of those priests are probably too large in the pandemic”, metzger. “I’m nice sunrise in the next year, is it is a very positive feeling around the technology, M & A, Typressed IOGHS. He can get it very worst, but I hope it is going to be better.”

And companies are often contradictory things themselves. Meta said placed over 3,000 people, with a focus on poor handcuts. But also announced can invest as much as $ 65 billion in AI.

“I believe that I will continue to develop a lot, very quickly. And if you are looking for those companies may be very effective and they need fewer people”, metzger said. “It’s positive if businesses can iterate faster”.

Key growth magicians are planning to include a ai platform, technology, and block, drive from the fort of encryption of cryy and the new US administration.

With important releases as the Nintendo Switch 2 and grand up in 2025, the gaming industry is ready for significant commitment to the player’s commitment, the metzger. This surgency could also drive fundraising and m & an opportunity for gambling companies.

Of course, lost that the short or long run, there is no chance with the Consolance of the Donald Trumps Trumps to impose the fee. If you persist a long time, it could rob the company’s economy.

With public markets refund in 2025, Drake Star anticipate the IPO game businesses to go public this year. Firm Anyo also the start of a wave of II United States of Indian game companies.

https://venturebeat.com/wp-content/uploads/2025/01/drake-star-2.jpg?w=1024?w=1200&strip=all

2025-01-30 18:00:00