MicroStrategy buys another 1020 bitcoins

Disclaimer: The analyst who wrote this article owns shares of MicroStrategy (MSTR).

MicroStrategy (MSTR) increased its bitcoin (BTC) holdings for the ninth consecutive week.

MicroStrategy has more bitcoins than any other publicly traded company. In the week ending January 5, MicroStrategy bought another 1,020 BTC for $101 million, bringing its total bitcoin holdings to 447,470 BTC.

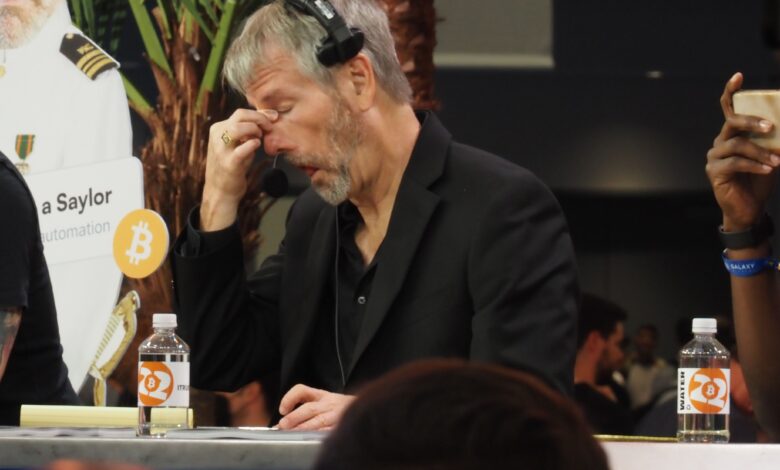

It wouldn’t be Sunday without executive chairman Michael Saylor teasing the announcement. Statement on X. The average purchase price of Bitcoin was $94,004, pushing the average price to $62,503.

The latest bitcoin purchase was financed through the sale of shares under the company’s over-the-market (ATM) program, for which $6.77 billion remained in the ATM program.

Shares recovered on Friday with a 13% gain after falling nearly 50% from $543 on Nov. 21, and the stock is trading around $353 — up 2% — in premarket trading.

In addition, MicroStrategy announced that it will raise up to $2 billion through a offering preferred stock. This $2 billion proposal includes a separate $21 billion in equity and $21 billion in fixed income for the 21/21 plan.

Preferred stock has priority over Class A common stock. Some of the features of the draft include provisions allowing for conversion into Class A common stock, payment of cash dividends and share repurchases. The terms of the perpetual preferred stock and the offering price have not yet been determined, and the offering is expected to take place in the first quarter of 2025. The purpose of the offer is to get more bitcoins for MicroStrategy.

Source link

https://cdn.sanity.io/images/s3y3vcno/production/35d4fedb4ebcb9e6e9c2d5dffd490c9212d56dc6-4132×3099.jpg?auto=format