No one bothered banks

Hey!

The biggest US banks recently reported their fourth quarter and total year results in 2024. And you know what? Banks are very good. It realizes me that, in sadness, Despite approximately 30 years of trial, fintech companies do not interfere with banks. At least, not the big.

Yes, there are examples of fintech companies that challenge banks in some places, but They barely challenge the key model of banking – take deposits and issuance of loans. Until these tasks are not disturbed, we cannot talk about the fintech that bothers banks.

Perhaps, disturbing major banks takes a lot of time or even a change in consumer generations. Or, perhaps, Banks and fintech companies need to learn how to go with. In any case, I don’t think the future of the fintech industry is maked.

Yevgeny

PS If you have feedback Reply Ani email or ping me On X / Twitter

Let’s talk about deposits first. Money Center banks survive “Deposit Flight”. The JPMorgan Chase, Bank of America, Wells Fargo, and Citi all reported, small, but however the retail deposits (consumers and small businesses). The region’s banks are also good.

“Deposits of the whole company stabilized, and We are looking forward to seeing a more visible growth trend express self in the second half of 2025. That is remarkable We see that trend in consumer checking deposits. “

Jeremy Barnum, JPMorgan Q4 2024 Income Call

The past few years seem to be A Perfect Time for Fintech companies to get deposits. First, the stimulus money is hit by bank accounts, with limited ways for people to spend it. The Federal Reserve then raised interest rates, so that one can only park deposits in the treasuries and can also offer a reflection of the depositors.

Sofi and LendingClub start offers High-Yield Savings Accounts to move people their money from incumbent with no charge. And incumbents don’t have much to do with it, because the reprcess of their current portfolio is more expensive than allowing some deposits to leave.

More exciting is the cash app associated with Wells Fargo (and wise with Chase) to offer storage accounts with high yields with their customers. The message is “These customers want to bank with us todaySo if you want to access their deposits, you need to pay. “Wells Fargo and Chase requires deposits and pay 4% + rates (without risk to their own customers asking the same rate).

However … Bank of America still pays 64bps to $ 942 billion deposits. Deposits are high, and the bills paid to banks for these deposits are reduced. Therefore How long will Wells Fargo continue to pay 4% of customers in the cash app? Maybe they don’t need deposits from clients in the cash app?

“The biggest consumer story this quarter is deposits because These are the most valuable deposits of franchise. And in the last 6 months, we believe we saw the floor starting to form after several stages of slow decreases. Consumer Banking deposits appear to fall in the middle of August at around $ 928 billion and ends the year at $ 952 billion on the last basis.

Alastair Borthwick, Bank of America Q4 2024 Income Call

And what about lendingclub and sofi? At the end of Q3 2024, LendingClub has $ 9.5 billion deposits, and Sofi has $ 24.4 billion. It is an impressive growth, but obviously not a degree of disruption. Fintech companies have a chance, and they blow it.

But the more disappointing than that Fintechs are unable to challenge banks to lend. Again, at least not the big ones. Let’s take credit card lending, which, in my eyes, is the product that has been for a long time.

In 2023, the affirm launched its affirm card. This card combines the function of a debit card in BNPL lending, and in theory, can be a challenge to traditional credit cards. The affirm has easily reached 1.4 million affirm card cardholders.

Robinhood also launches its Gold Card last year offers 3% cash back. Robinhood admits that 2 million people are in the waitlist for this card.

“While, Robinhood Gold Credit Card exceeds 2 million in Waitlist and adds nearly 200,000 waitlist sign-ups per month. So at that rate, we don’t have to worry about getting customer or credit card users at least in the next few years.

Vlad Tenev, Robinhood 2024 Investor Day

But, In 2024, Amex opened 13 million new card accounts, Chase opened 10 millionThe Bank of America opened 4 million, and Wells Fargo opened 2.4 million.

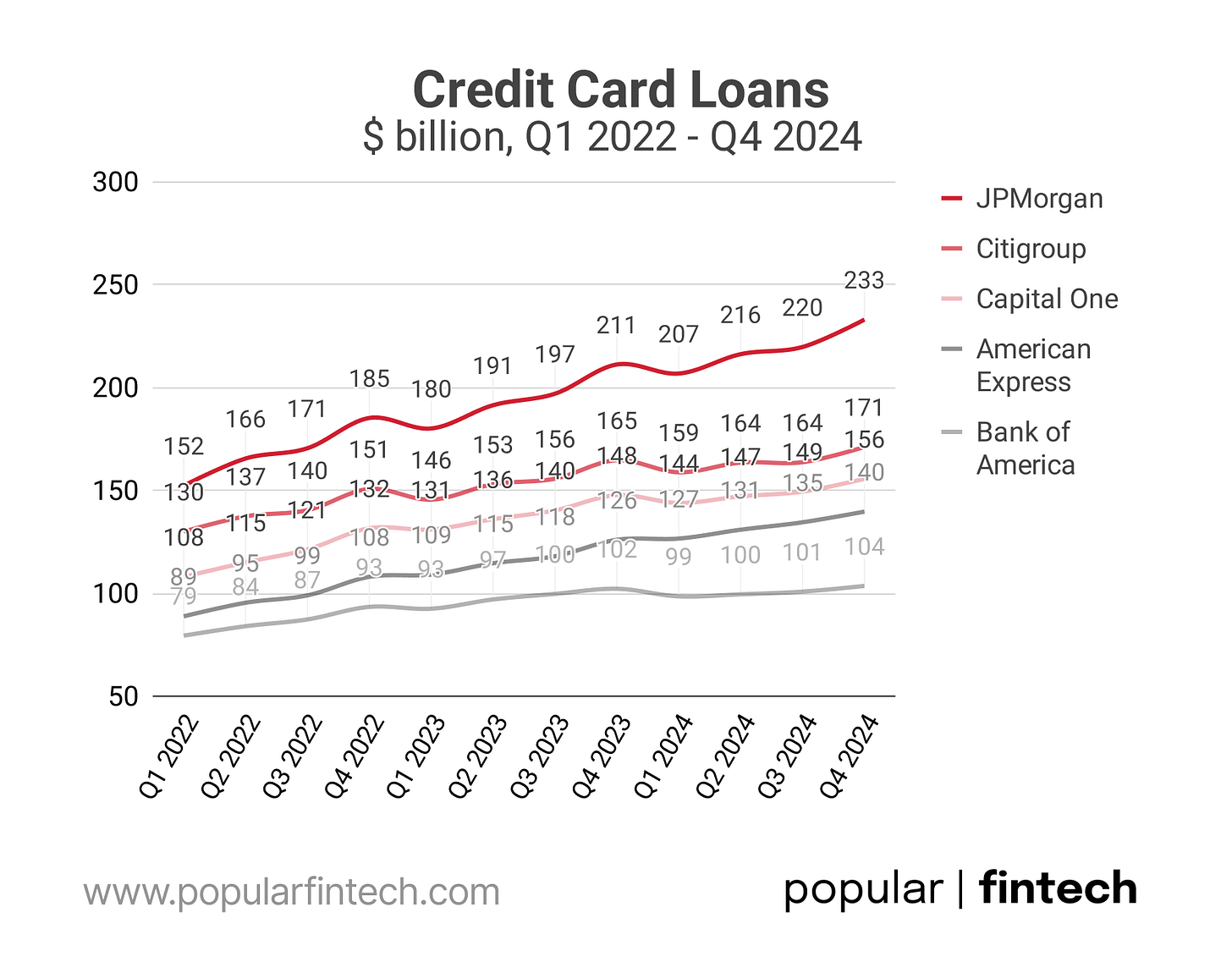

JPMorgan completed 2024 with $ 233 billion credit card loans (from $ 152 billion three years ago), Citigroup with $ 171 billion (from $ 130 billion), and Capital One with $ 156 billion (from $ 108 billion).

We look forward to healthy card loan development this year, but under the 12% step we saw in 2024Because the tailwind from the normalization of the revolver is behind us.

Jeremy Barnum, JPMorgan Q4 2024 Income Call

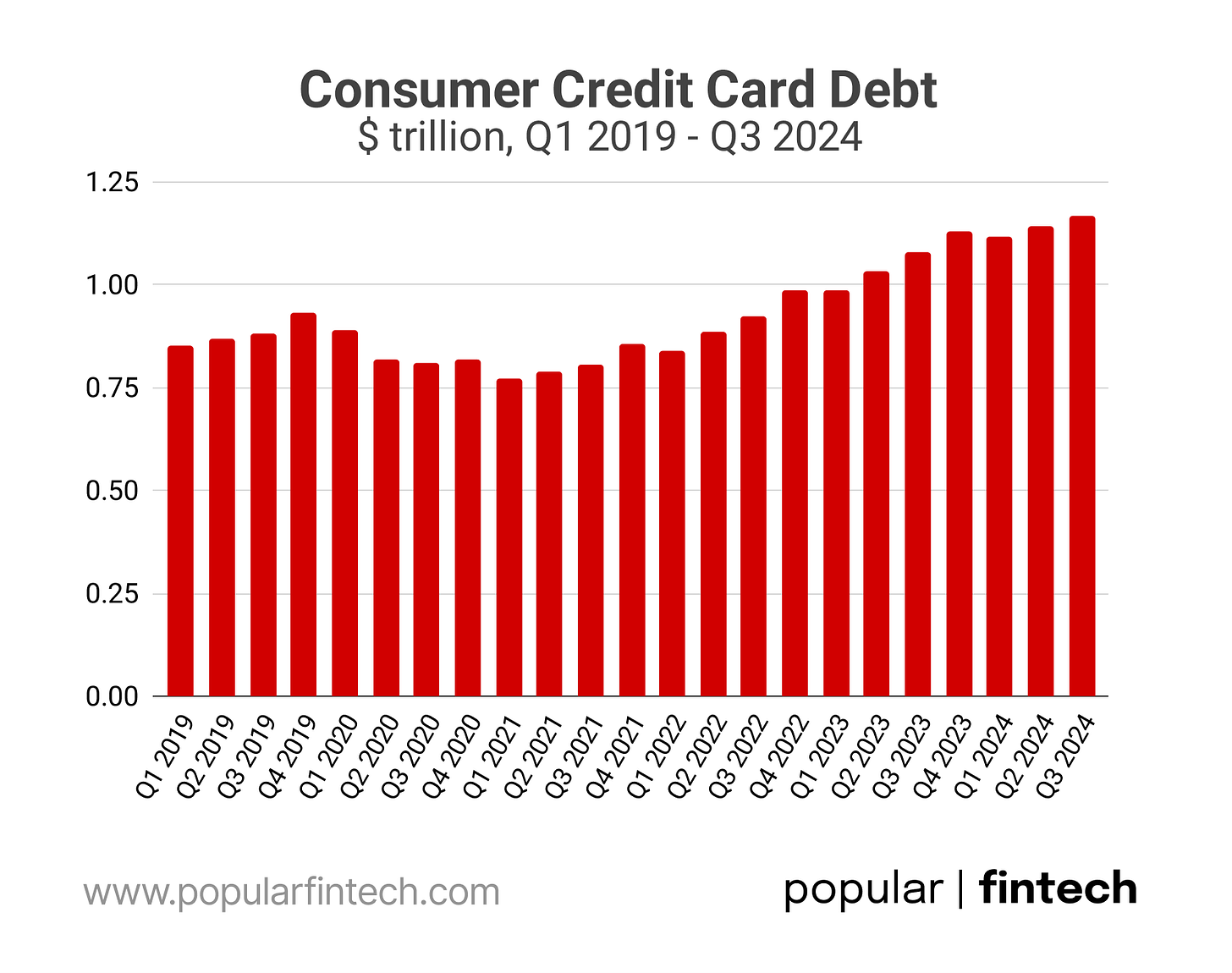

Again, the In the past few years is the ideal for building a credit card business as a loan balance exploded. Outstanding Consumer Credit Card Debt is under $ 0.77 trillion at the beginning of 2021, and then rapidly growing up to $ 1.17 trillion at the end of Q3 2024. And fintech companies did nothing about it.

“… from A fintech’s view of the consumer’s part, we never saw anything. Not to let us not see, not before we know it. Our customer is the one who appreciates the experience of accessing and service as well as its rewards …

Stephen Squeri, American Express Q4 2024 Income Call

Don’t make mistakes, fintech companies achieve a lot! Banks can lose (or have already lost?) Business receiving the fee of fintech companies. The JPMorgan Chase is probably the last big competition in the bank weathering well, but Stripe and Adyen get easily.

Payments … .NG is given to business, due to price pressures, Do you think if you need to remove this business and spread capital to other places where you are in a more stable positiongets better returns?

The Analyst Income Analyst Income Call to US Bank Q4 2024

Also the small business lending (and perhaps, even small business banking) can do “by vertically-focused software platforms staring at creating “operating systems for SMBS” (Consider square, shopify, and toast). After all, Square has already begun many small business loans than Chase.

Can also be banks lose the cross-border payment business wise and honest.

… and Ramp and Brex are definitely become a force of commercial cards.

“… Yes, We watched the ramp, BREX And everything is there. They work from a small base, but they have good products, and they make some entriesAnd we make sure we respond to that. “

Stephen Squeri, American Express, Q4 2024 Income Call

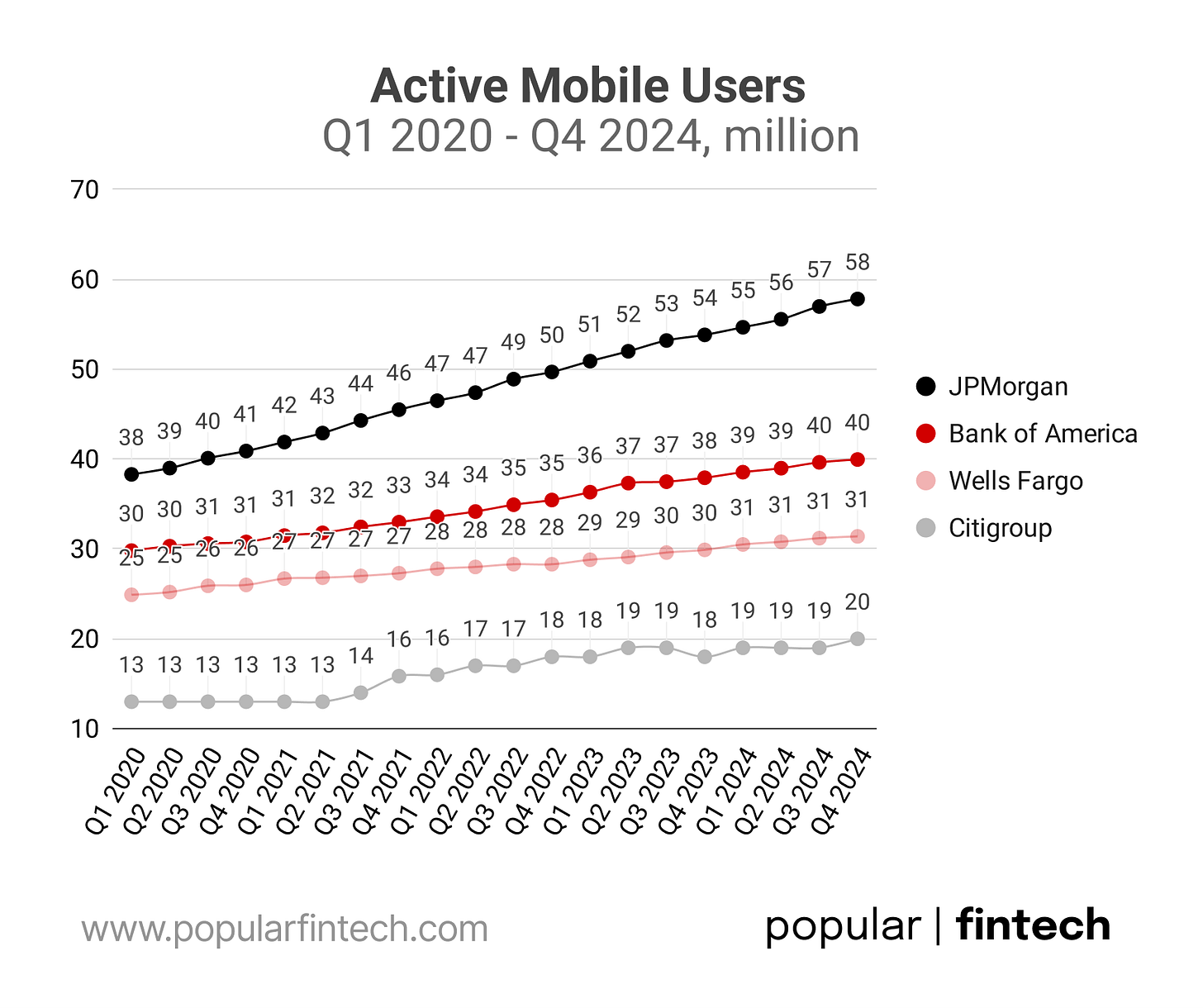

… but (and that is an important but!) Large banks also think of mobile. Remember? Fintechs (and especially Neobanks) may win due to better UI / UX. Mobile first / mobile only, everything.

JPMorgan Chase reports 58 million active mobile users At Q4 2024, Bank of America 40 million, and well Fargo 31 million. How many fintech companies have this scale? Two: Cash app and PayPal / Venmo.

Yes, big banks throws billions of catching fintech companiesBut they do it while still delivered a fool of high profits. JPMorgan’s Consumer & Community Banking businesses in approximately 30% Roe. The part of the Consumer Banking of the Bofa moves in the middle of Twenty Roe.

“I mentioned how We may have reached the highest cost of modernization. Let’s continue with modernization. But in margin, that means that within the tech teams, there is little capacity to release to focus on parts and new product development. “

Jeremy Barnum, JPMorgan Q4 2024 Income Call

So, we can never say that fintech companies bother banks, at least great banks. Fintech companies can interfere with community banks, but is that ambition? I am sure that investors have not shed billions in the fintech industry to disturb community banks.

After all, about a dozen or more largest banks (with $ 250 + assets) generate 60% of industrial income (and hold 58% of deposits).

So what is needed for fintech companies to interfere with big banks? More time? A change in generations? Or maybe, Banks and fintech companies need to learn how to go with. In any case, I feel the future of the fintech industry can be as exciting as it starts.

Source in the cover picture: America’s bank

Disclaimer: The information contained in this newsletter is intended for educational and information purposes only and should not be considered financial advice. You should make your own research or ask professional advice before making any investment decisions.

https://substackcdn.com/image/fetch/w_1200,h_600,c_fill,f_jpg,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe2ef9d75-ae0a-4f4c-9d8f-ef178e9f0cff_1577x980.jpeg

2025-01-26 17:05:00