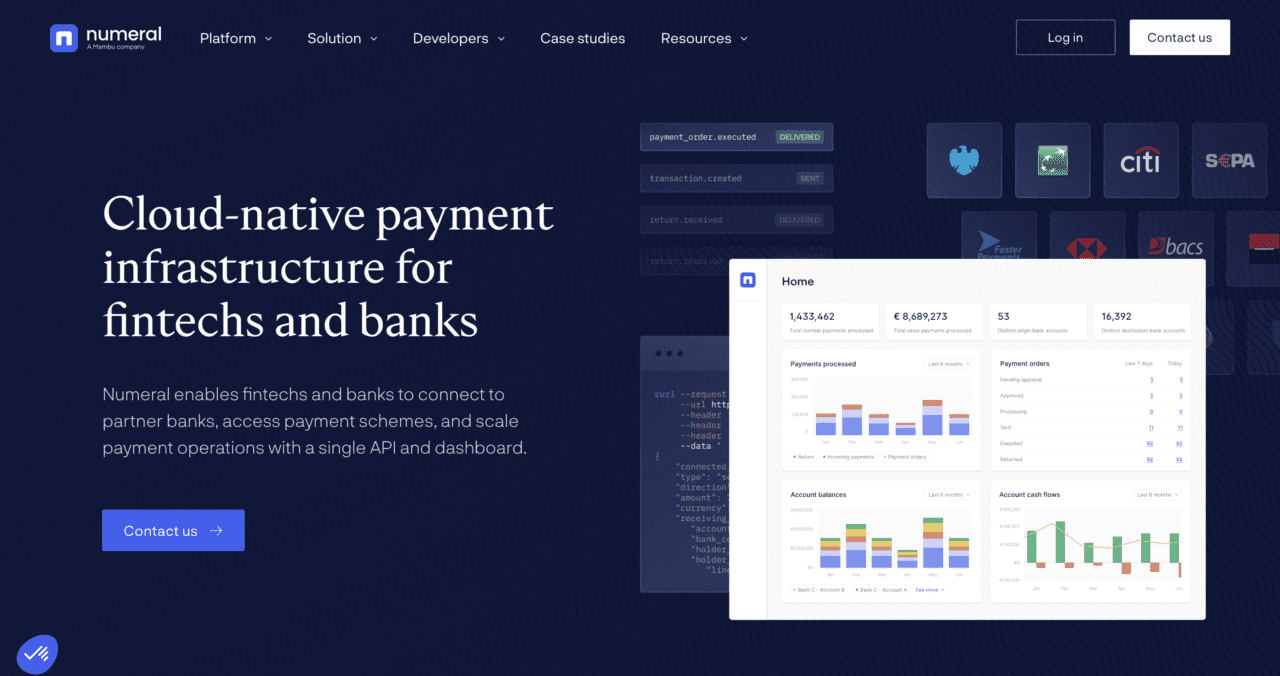

Numeral Perfect Complete Payment Verification (VOP) solution

- Technology technology for financial institutions, numbers, opens full management of payee verification (VOP) solution this week.

- The new offering helps financial institutions in the European Union meet new VOP needs in months ahead of October 9 Deadline Regulator.

- French headquarter, the number makes the final debut at the fincouveeeurope 2023. The company was captured by the fintovate alum mambu partner in December.

numbera provider of payment technology for financial institutions, polled Perfect payment verification (VOP) solution this week. Technology will allow banks and other financial institutions to pattern Vop policy in the European Union on October 9, the deadline specified in regulates.

“In number, our mission is to provide financial institutions with future-proofers and adherence to the payment infrastructure,” Numeral CEO and co-founder Édouard monon said. “Our complete handling of payment fees, fulfilling our customers to fulfill the VOP fully with our streamline payment infrastructure. Our full-managed approach ensures that they can and remain following No need to navigate the complexes of the Scheme Seerce and ongoing operation. “

The numeral solution comes while Europe is looking for ways to fight the decline in the payment – especially the research fraud (app) at one time the payment fees are more popular and available. In this purpose, new regulations for Payee (VOP) verification that the payment service providers (PSP) provide payment details to pay payers.

VOP’s offering in numeral provides a managed procedure that deals with all regulatory and technical requirements involved in shipping and responding to vop requests. The solution supports the payment process from the Vop Scheme scheme to go to the array and Synchronization of Account Data through SFPP, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, API, manual upload. VOP Technology also reduces a configurable algorithm that stores risks at risk of risk and a seamless user experience. The company also produces a publication, The Last Guide to the Payer VerificationTo help finance institutions can better understand the Vop scheme.

“The pre-validation of account and domestic verification is very important for their desired use cases, but vop should not be achieved,” says the Numeral Head Marketing Matthiuu Blandineuu. “The Vop Schood of the European Pay ensures the lateness of PSPs and countries by default, and our solution helps financial requirements in time, with fewer resources.”

Headquartered in Paris, France, numeral makes perdovate perdovate to Fincouveeurope 2023where it shows a API platform that enhances the payment operations by processing bank payment. Specifically, the formation shows how to shipping the platform, receives, and reconstructed Sepecile payments and handling errors by the Retails by the Retal

Built in 2021, the number Obtained by fellow fintovate alum Smell on December 2024.

Views: 0

https://finovate.com/wp-content/uploads/2025/02/pexels-huy-phan-316220-1397518.jpg