Stocks are close to removing the Trump Bump as the fear of taxes

(Bloomberg) — It’s the round-trip ticket no one on Wall Street wanted.

Most Read by Bloomberg

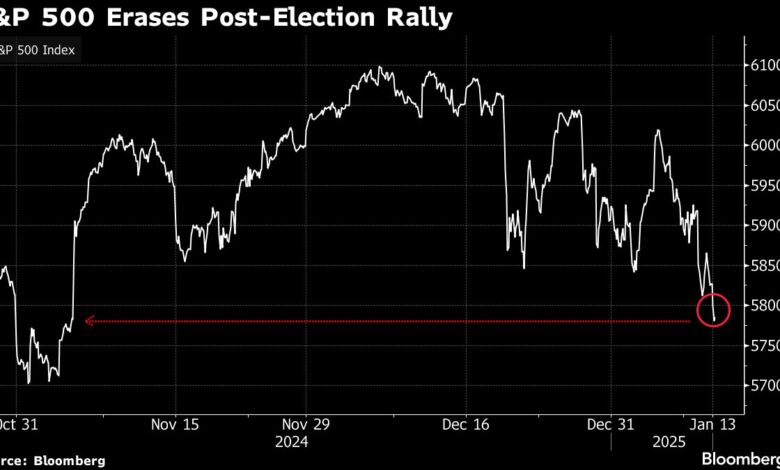

The S&P 500 Index on Monday briefly fell below where it ended on November 5, shortly before Donald Trump was elected president, and closed just slightly above that level on Monday. Investors are dumping stocks and interest rates are rising as fears grow that inflation remains stubborn and the Federal Reserve will have to rethink its plans for interest rates this year to fight it. Friday’s surprisingly strong jobs data only heightened those concerns.

The stock benchmark fell to a low of 5,773.31 earlier in the session, but pared losses to end the day modestly higher at 5,836.22. Before the votes were counted on election day, the S&P 500 closed at 5,782.76. It then jumped 2.5% on Nov. 6 after Trump was declared the winner, posting its best post-Election Day session ever. And it continued to climb for the following month, finally rising by 5.3% from November 5 to its peak on December 6.

There are several reasons for the fall: The economic outlook deteriorates; investors are increasingly concerned about high stock valuations; and growing anxiety about the Fed’s rate path. Traders also sized up the potential implications of Trump’s proposed policies, which include huge tariffs on imported goods and mass deportations of low-wage undocumented workers.

The fear has already appeared in the bond market, where the yield on the 20-year Treasuries is above 5% and the 30-year yield rose above the level on Friday before slipping just below. Now the policy-sensitive 10-year yield has soared, reaching the highest level since the end of 2023.

Stock market volatility is also on the rise with the Cboe Volatility Index, or VIX, hovering around 20, a level that typically indicates distress among traders.

“This is a case of high expectations meeting reality,” said Michael O’Rourke, market strategist at JonesTrading, noting that turning campaign promises into policy is an arduous process.

There is also a growing understanding that tariffs will be a key policy of the new government, something that investors typically do not like, given that tariffs tend to weigh on growth. “The honeymoon may be over,” added O’Rourke.

Different market

One thing that is clear is that Trump is entering the White House with a very different stock market than he did in 2017. For starters, ratings were barely flat then, but they are now at precarious levels. The S&P 500 is up more than 50% since the end of 2022 after posting gains of more than 20% for two consecutive years. Only in 2024, he made more than 50 records. Compare that to Trump’s first term, when the S&P 500 was coming off a 9.5% gain in 2016 and had only risen 8.5% in the previous two years.

https://media.zenfs.com/en/bloomberg_markets_842/e3b78808e1b6ff4756a590ee22f2296a

2025-01-13 21:35:00