The price of bitkoin prices per move

Bitcoin is under the main movement of the main price and the data believes that variables may be back in a big way. During the last few weeks, consider the key indicators to understand the potential scale and direction of the next step, in the past few weeks.

Variable

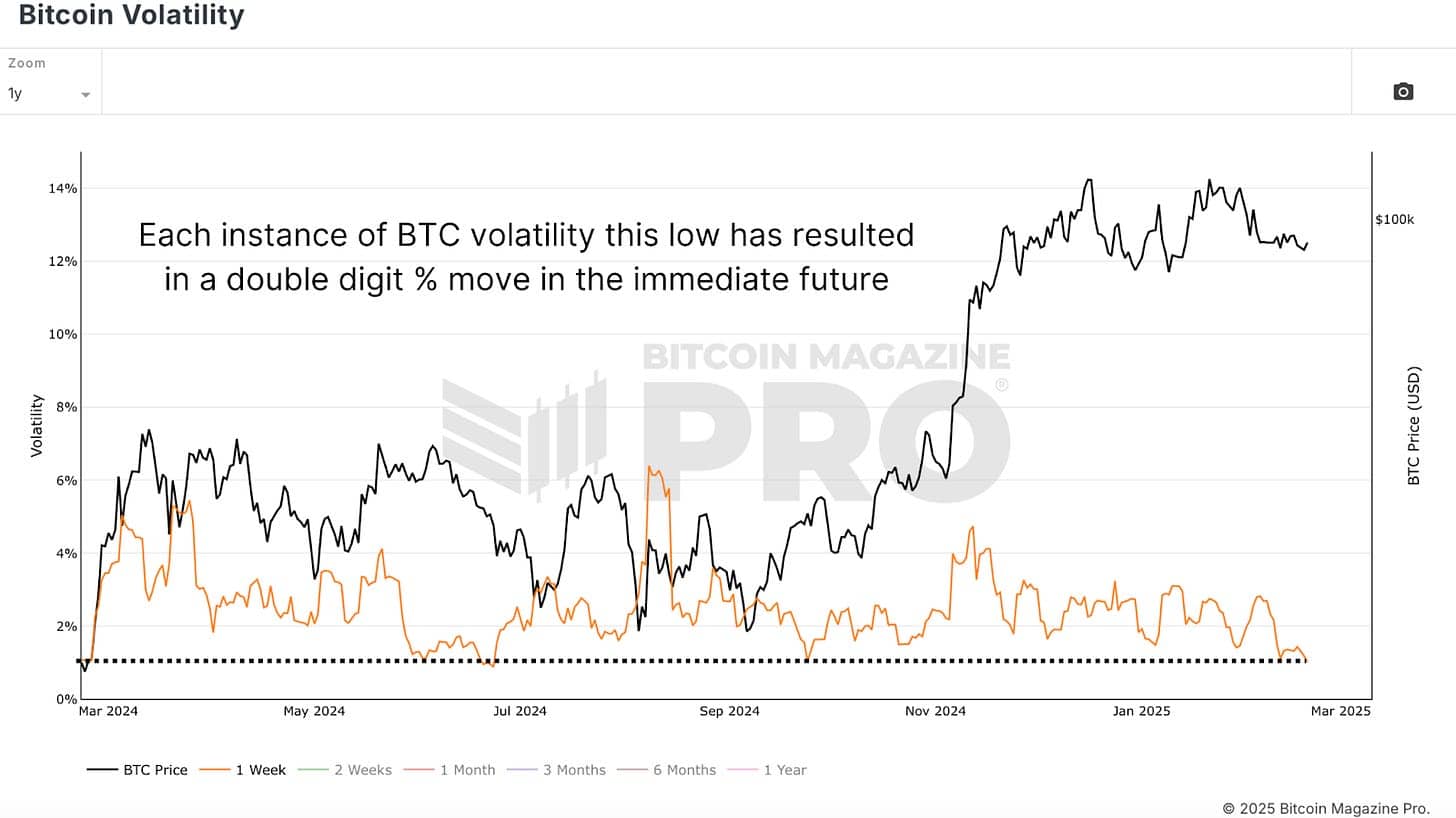

Great place to start Bitcoin variableOver time, over time, the action and volatility control. By insulating the weekly information of the last year, we will notice that Bitcoin has been compared to the price of the Bitcoin, which will soon visit $ 90,000 in a range of $ 90,000. This long-standing sides have led to a dramatic drop of change, and Beatkoin feels a part of the most stable price to last history.

Historical, such variable level is rare and shorter. When reviewing previous cases of unchanging cases, Bitcoin began with a serious price movement:

£ 50,000 rallies and then rises above $ 74,000.

Up to $ 56,000 to $ 55,000 and then to $ 68,000.

Up to $ 100,000, about $ 60,000 periods before its current height is estimated to $ 400,000.

As below the lower level, the bitkoin was at least 20 to 20% of at least 20-30%, if not in the following weeks, and did not exist in the next weeks.

Bolindjer

The group of Bolts will no longer be actual to deviation from the price deviation, as well as alanes of the deviation of the average average. Currently, at the level of the level, the price of prices since 2012 has the extreme level. The last time this was Bitcoin, according to 200% of 200% of 200%, in several weeks.

Review the set of such a sweet Bondic group, we will find:

2018: $ 6,000 to $ 3,000 in cheaper 50%.

2020: to $ 12,000 to $ 12,000, up to $ 12,000 to $ 40,000.

2023: The summer season for $ 25,000 before the speed jump is $ 35,000.

Potential direction

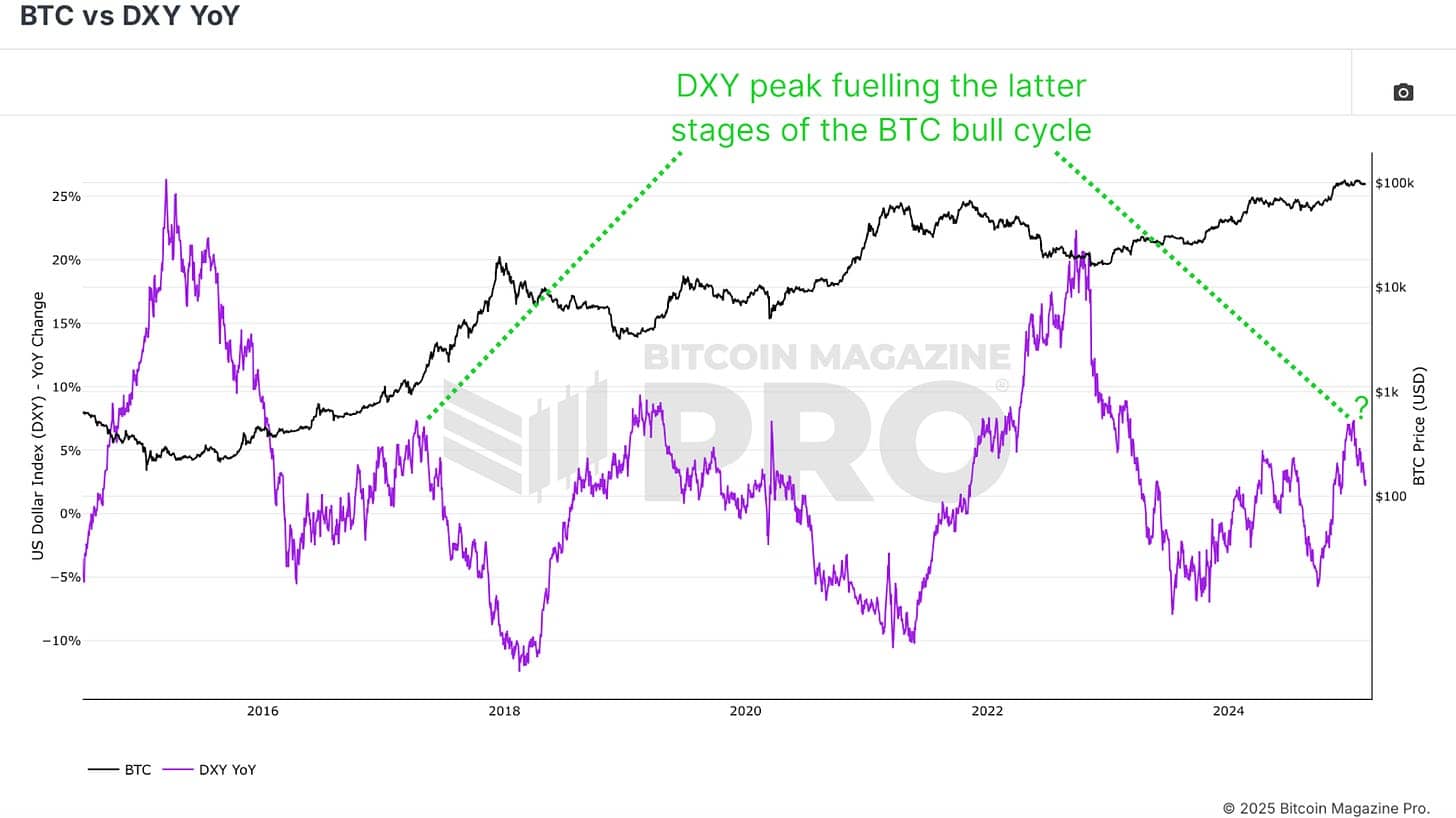

The actual direction is more difficult than predicting variability, but we also have. Is a strong indicator Index of power of US dollars (DXY) YOYHistorically to Bitkoykoin. Dixy recently suffered, but Bitcoin held his own land. This brings bitcoin, even in small attractive macro, also brings strength.

In addition, political factors may play a role. Historically, Donald Trump visited, and Bitcoin has been rejected and bitcoin operated to $ 1,000 to $ 20,000. Although the same installation is formed in 2025, we may see the repeat of this dynamics.

Etf

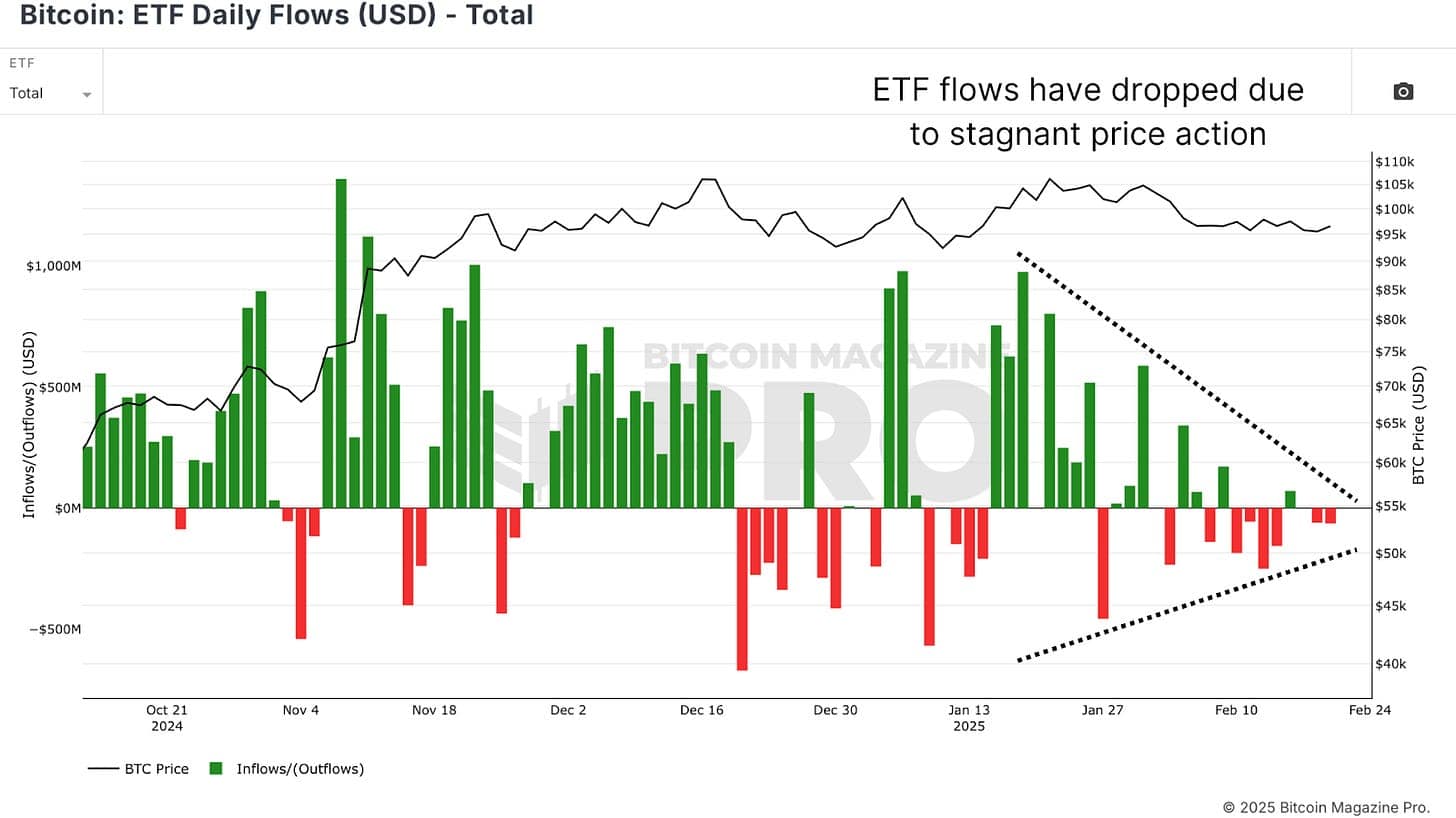

In addition to Bitcoin EtfFor the institutional request, proxy slowed down during this period of changing. This indicates that the largest players are waiting for the cruelty that contained it before adding their positions. The precinct respected, we will be newly interested in institutes, driving bitkoin, and higher

Conclusion

In one of the lowest levels of change in history and such conditions never lasted long. The installation is reduced by this, which establishes the stage for an explosive step. Data are coming out of date, and whether it is a variety or bear benefits, whether it is macroeconomic conditions depends on the Senim and institutional flows.

For more bitkoine analysis and, as the leading diagrams, personalized indicators, have the leading capabilities to receive depth and individual information in depth Bitcoin Magazine Pro.

Reply: This article is only for information purposes and is not considered financial councils. Always do your research before accepting investment decisions.

Source link

https://bitcoinmagazine.com/wp-content/uploads/2025/02/bitcoin-volatility-imminent-data.jpg