The ratio of Bitcoin to gold reached an all-time high as the year-end rally took off

Bitcoin’s climb to new highs this week pushed its relationship to gold to a record high as institutions continue to pile into the digital asset heading into the end of the year.

The ratio, which measures how many ounces of gold one Bitcoin can buy, hit an all-time high of 37.3 on Monday, meaning one Bitcoin can now buy about 37 ounces of gold — a new all-time high.

The reading is roughly half a point higher than the 36.7 during the height of the crypto’s previous bull run in November 2021.

Sidney Powell, CEO and co-founder of institutional capital markets Maple Finance, said: “The new high represents the acceptance and maturity of Bitcoin as an asset class.” Deciphering. “We expect to hold the ratio based on the tailwinds of ETF flows that have historically increased over time, and bitcoin is increasingly viewed as a key component of balanced portfolios.”

Calculated by dividing the price of Bitcoin by the spot price of gold, iet is usually the relative strength between two assets and serves as an indicator to compare investor preferences.

The ratio cements Bitcoin’s status as digital gold, positioning it as an “increasingly improved store of value over traditional gold,” Singapore-based digital asset trading firm QCP Capital wrote. warning On monday.

Still, traders continue to choose gold amid uncertainty over Bitcoin, which is more closely related to traditional markets thanks to the approval of US Bitcoin exchange-traded funds in January.

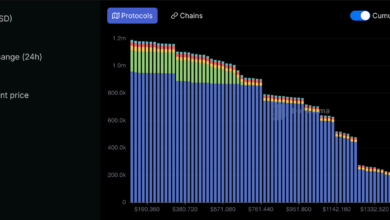

Global Bitcoin ETF funds under management reached $119 billion, according to Coinglass data shows. That’s less than half of the $290 billion in gold-backed ETFs as of November 2024. data From the World Gold Council.

Bitcoin’s code limits its maximum supply to 21 million tokens and includes halving events that periodically reduce the new supply by 50%, meaning the last Bitcoin won’t be produced until around 2140.

Its programmed scarcity contrasts with the continuous mining of gold, but both assets are often compared as stores of value due to their limited supply characteristics.

In any case, gold remains bearishly volatile – about 20% annually – and, benefiting from its 3,500-year history as a trading asset, Bitcoin offers high return potential with near-50% volatility despite significant price swings.

Edited by Sebastian Sinclair

Daily information Bulletin

Start each day now with the best news, plus original features, podcasts, videos and more.

Source link

https://cdn.decrypt.co/resize/1024/height/512/wp-content/uploads/2021/02/bitcoin-gold-gID_7.png