Why is not a strategic cow?

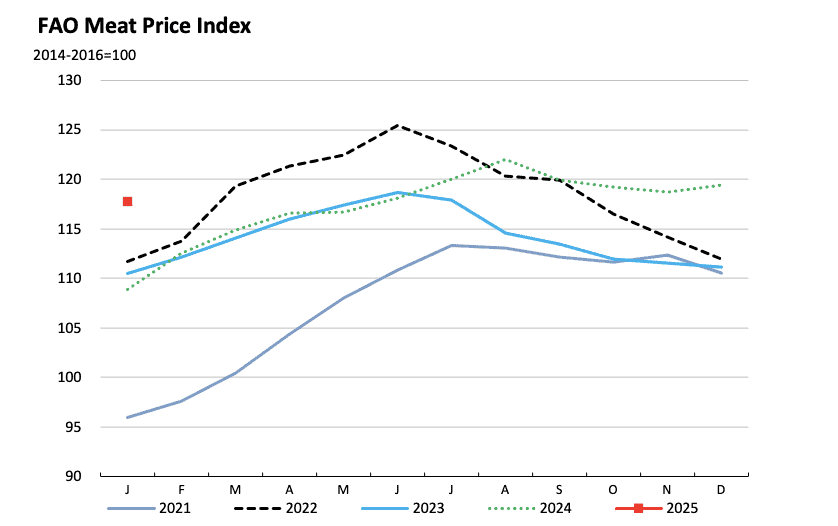

Question of the reserve bank (SARB) governor, “Why isn’t the strategic cow?” Despite the world’s financial shiftious in the Davos, north-Khaniaago talked about African reserves, according to Africa’s financial shifts. The more growing concepts in digital transformation is growing and increasingly developing. Africa is not a stranger for commodity-based economies. For oil and coakao, beef relies on the natural root for economic root. However, these goods face difficulties. Global goods prices range from market changes, geopolitical tensions and climate change. For example, beef price is likely to change the sharp change or exposed to trade limitations Food and Agriculture Organization (FAO), The price of the cow has a variable of variables, which lasts up to 30% at the expense of foot-mouth and export prohibited factors.

Photo source: FAO

Brian Armstrong, Director General of the Director General Kaghanyaago’s general principal: Beatkoin is not a form of money, it is still mobile, divisive and useful. Over the past decade, Bitcoin exceeded each main class of different main assets, which has accepted his position as a higher store. Africa often marched in the global financial system, and this strategic bitkine can be the key to disclosure of economic independence, innovation and long-term prosperity. How can?

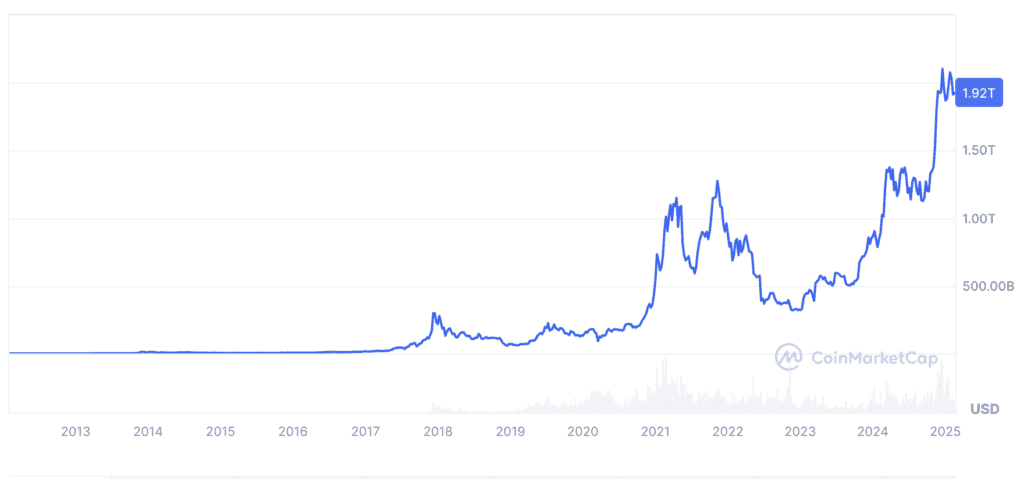

It should be noted that we need to be relatively real. Bitcoin Goods such as digital, such as physical storage, cows and meat should not store unforeseen goods and costly. Losses after the World Bank from the harvest of agricultural products will be estimated every 48 billion dollars for $ 48 billion every year, and determine the inefficiency of reserves on goods. If the goods have internal values, their usefulness is limited to specific sectors. On the other hand, the global, unique properties of bitco, are an ideal, unique personal, or ideal candidate, make it ideal to the strategic reserve asset. Bitcoin, equipped with 21 million pieces, is defiled by unknown or cow with unlimited reproductive mechanisms. According to CoinMarketCap, capitalization in the bitcou market at least 1 billion in 2013, more than 1 billion in 2025, Assessment of his fast was accepted and gratitude.

Photo source: Coin

Why is Bitcine over the cow?

Bitcoin For several minutes to transfer boundaries and small units, selling, and more practical than gold or cows. Over the past decade, Bitcoin has the average annual income of the average annual average annual income, gold, reserves and real estate. Research Fedilectial investment has shown that Bitkou’s return returns are higher than traditional assets, Make a pleasant option to maintain a long-term wealth. Global global nations have not recognized the Bitcoin potential as a reserve asset. El Salvador In 2021, Bitskoin has been accepted as legal tender, and the countries such as Switzerland and Singapore entered Bitcoin in their financial system. This 2025 and the United States Strategic Bitcoin Rule in the pipeline. In 2023, one of the chainion, Africa, Africa, KRIONNC markets, is one of Nigeria, Kenya and South Africa, Nigeria and South Africa.

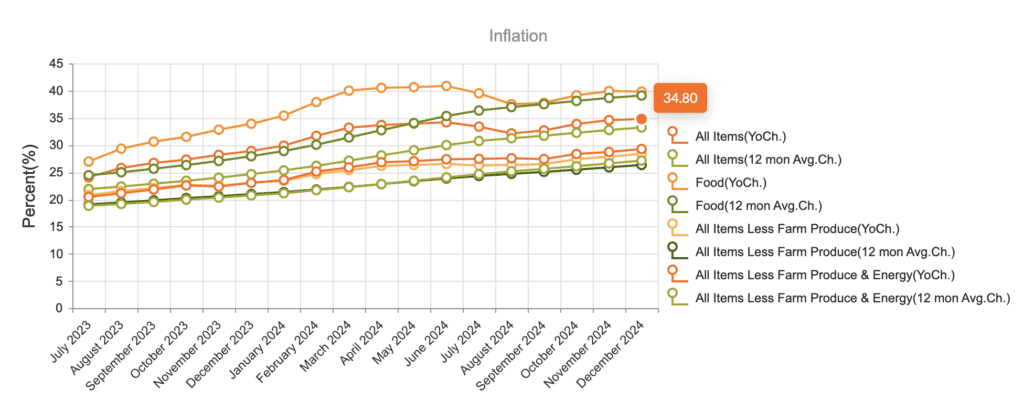

Bitcoin’s Deflysalary Nature Effective Inflation Effective inflation Effective inflation, which challenged many African economy. For example, Nigeria’s inflation rate will increase by 34.80%, Violation of Value of Naira. Bitcoin Reserve protects national wealth from this devaluation. By allocating 1% of its reserves, it can cancel the billiontones from Africa and Africa. For example, if the joint foreign external reserves of the continent thanks 5 billion 5 billion to 5 billion dollars to 5 billion dollars to 5 billion dollars, and the cost of Bitco will provide $ 50,000 in profits. Unlike the cow production, it contributes to the forest production and works in bitter energy and renewable energy. Cambridge Bitcoin According to the consumer index of electricity, 58.5% of the World Bitkoin Mount Mount the Mount Bithkoine works with renewable energy by 2021. The wide range of Africa and hydropower plants Ideal for the Permanent Bitkoin mining. Preservation and management of Bithkoine will be more valuable than storage of trade reserves. No storage costs, there is no threat of danger and complex logistics.

Photo source: Central Bank of Nigeria.

El Salvador’s legal admission as legal tender ensures valuable concepts for Africa. Despite the initial skepticism, Bitcoin strengthened tourism and foreign investment to El Salvador. According to the central reserve bank, the Central Reserve Bank said that in the first year of Bithko’s adoption, the first year of the year has increased. More than 70% of El Salvadova has previously failed to access banking services. Bitcoin helped millions to participate in the world economy. El Salvado threw a bold step towards the financial independence by relying on the US dollar. Most Africa, most of the US dollar, has left their own economic policy weak for trade and reserves. Bitcoin is a central alternative to reduce the trust in traditional financial systems.

With the establishment of the strategic Bitcoine’s reserves, Africa can support his economic prospects, protects its wealth from inflation, and promotes a global leader in a digital economy. In addition to obsolete economic models, it is time to accept the future of money. As Armstrog, Bitcoin is not a better form of money; This is the basis of a new financial paradigary. Selection for Africa Open: Bitcoin, not beef, is a prosperity road. Bitcoin represents the class of transformational assets that offered unparalleled advantages over traditional goods, such as cow or sheep.

This is a guest post with this inheritance. These ideas are completely themselves themselves, and they do not necessarily reflect BTC Inc or Bitcoin magazine.

Source link

https://bitcoinmagazine.com/wp-content/uploads/2025/03/Bitcoin-And-Africa-Why-Not-Strategic-Beef-Reserve.png